The Perils of Incorrectly Filing 1099s

Every year when you file your 1099s, the IRS will go through every record you submitted to ensure that the Tax ID (TIN), which can be either an EIN or SSN, matches the name they have on file. If it doesn’t, they may fine you $310 per record, which could amount to millions of dollars in penalties. These fines for incorrectly filing 1099s can end up as a major expense each year.

Luckily, BASELoad’s 1099 Corrections offers a solution by fixing your names before filing with the IRS, drastically reducing the number of mismatched TIN-name combinations on your tax submission. We don’t just validate, we correct. Check out this case study from a real client:

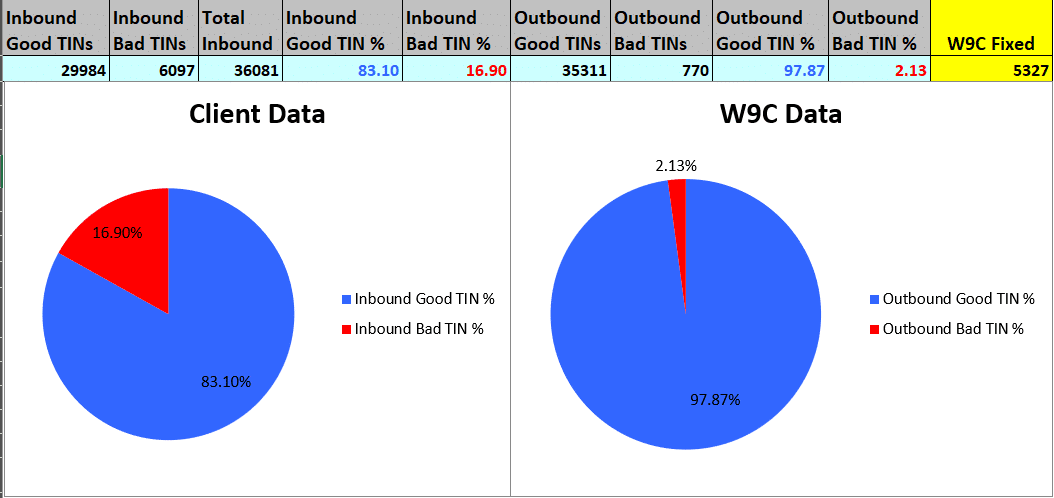

As you can see above, we were able to bring this client’s file from only 83% accurate to almost 98% accurate, potentially saving over a million dollars in IRS penalties.

But What About the Fallout?

While we can eventually bring your file to over 99% accurate, there may still be some mismatched TIN-name combinations. For these, we will proactively send out W-9 request letters and document every mailing.

If you receive any type of warning or an actual fine from the IRS, send a copy to us and we will deliver you “Reasonable Cause” data to help abate the potential fine.

What About Addresses?

Few things are more frustrating than working to ensure that all of your physical 1099s are mailed by the IRS’s January 31st deadline, only to receive a bunch back in the mail weeks later due to undeliverable addresses. Not only do you have to reach out to the providers one-by-one and obtain their correct addresses, but you’ll have to pay for new prints, new postage, and deal with angry 1099 recipients who are now waiting on you to file their own taxes.

We validate every address on your 1099 file to ensure that it’s deliverable and swap out invalid addresses for valid ones that we’ve seen in the past for those providers. This will make sure that your physical 1099s get to a verified mailbox and don’t just end up returned to you weeks later.

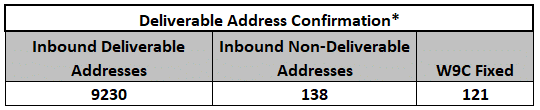

Here’s a chart showing the results of our typical Address Substitution:

As you can see, we were able to fix all but 17 of this particular client’s invalid addresses. That’s 121 fewer providers to call and 121 fewer mailings to reprint and remail.

Do You Do Mailings as Well?

Yes. We are a one-stop shop for collecting legal name/Tax ID combinations, correcting addresses, providing reasonable cause data, mailing W9 requests, mailing B-notices, and printing 1099s.

Can’t We Just Do This Ourselves?

Of course you can! However, that would require calling every provider to verify their names and addresses, generating your own 1099 forms, following up with corrections, putting the data into the correct format, and creating your own Reasonable Cause data for the IRS. Depending on the size of your organization, all of this could take hundreds upon hundreds of man hours and resources that you simply may not have, or would rather allocate to other facets of your business. With our 1099 Corrections solution, all you have to do is file and never have to worry about anything else. We fix it. You file it.